NEWS

Discover our article "Impact investing: a breadth of opportunity" published on Media Planet

The Pope Francis rarely makes headlines of financial newspapers. Media Planet dared to highlight the Catholic leader's vision of "putting the economy at the service of peoples", a vision shared by the social investment sector.

Investing for Good took part in the writing of "The Future of Impact Investing", a special edition of Media Planet published on Sept 28th 2018 as a supplement of The Guardian. Discover below the article "A breadth of opportunity" written by Geoff Burnand, CEO at Investing for Good.

The Pope Francis rarely makes headlines of financial newspapers. Media Planet dared to highlight the Catholic leader's vision of "putting the economy at the service of peoples", a vision shared by the social investment sector.

Investing for Good took part in the writing of "The Future of Impact Investing", a special edition of Media Planet published on Sept 28th 2018 as a supplement of The Guardian. Discover below the article "A breadth of opportunity" written by Geoff Burnand, CEO at Investing for Good.

To access the full publication, click here.

Impact Investing: a breadth of opportunity

Delivering the resources to achieve the Sustainable Development Goals in the next twelve 12 years requires concerted action at scale, so the recent involvement of mainstream financial institutions into impact investing is welcome. But beyond the positive headlines, many issues have yet to be satisfactorily addressed. Why is there not more competition among investors for projects explicitly focused on achieving the SDGs and the 2030 agenda? Are impact investors cherry picking deals? And in future times of duress, will investors maintain their commitment?

A greater opportunity set

One sign of the maturing market is a significant broadening of impact opportunities, hitherto disproportionately focused on microfinance, energy and social housing. Press freedom, for example – key to the development of peaceful, just and democratic societies – is now gaining mainstream appeal as an impact opportunity.

Eighty-seven per cent of the world’s population – about 6 billion people – live in countries without an independent press. Not only do peace, justice and strong institutions provide direct benefits to people in their everyday lives, they also underpin a wide range of SDGs.

How can you eradicate poverty (SDG 1) and hunger (SDG2) if you cannot create peaceful societies? How do you achieve gender equality (SDG5) without access to justice? How do you provide access to clean water (SDG6) or affordable energy (SDG7) without responsive institutions?

According to the UN, corruption, bribery, theft and tax evasion cost developing countries $1.26 trillion per year. Investing in independent news organisations can act as a strong brake on bribery and corruption and in both the public and private sector.

Impact investing in the arts

Another impact investment opportunity is a response to an adverse consequence of London’s rampant development. Although London is a city with extraordinary cultural vibrancy, 3,500 sites of creative production are projected to be lost by 2020 to short or expiring leases, to the actioning of landlord development clauses, or to the expiration of ‘meanwhile’ spaces. Few creative workspaces are owner-occupied and workspace operators often face major barriers to securing or renewing leases. They are often up against commercial developers and they lack access to financial support to take on development opportunities.

A new impact investing model, a creative land trust, based on a similar model in San Francisco, will acquire properties that will be leased to operators, thereby safeguarding affordability and long-term stability for London’s creatives.

Blended finance using grants from the public sector to underpin significant private finance investment will protect 1,800 creative workspaces and create 1,000 new ones, securing these spaces in perpetuity. London as a whole will benefit from the regeneration of under-invested sites through a stimulation of local business growth, preservation of the waning number of light industrial spaces, and the boost to the city’s world-class artistic and cultural value.

Impact investing for sexual and reproductive rights

Finally, sexual and reproductive rights for all, including the underserved, is a fundamental human right. Investing with impact capital in organisations that provide a range of health services including contraception, breast, and cervical cancer screenings, HIV prevention and treatment and safe abortion can provide millions of life-saving services annually. In many instances, these organisations have developed repayable social enterprise models that help meet the increased demand for reproductive health services and are gaining support from impact investors to implement sustainable growth strategies.

The right balance

The range of these examples reflects the diversity of opportunity that impact investing now presents. However, its future is dependent on achieving the appropriate balance between encouraging further institutional investment on the one hand, without on the other compromising the value created by those organisations dedicated to delivering a world with greater equality. Bridging the gap between the fundamental investment expectations of mainstream capital and the reality of impact investing needs innovation, expertise and a nuanced approach. Investment models that blend public and private finance optimally allow impact driven organisations to be financed by additional sources of capital while retaining the integrity of their mission.

Blended Finance - A Brief Introduction

Blended finance is the complementary use of grants (or grant-equivalent tools) and other types of financing from private and/or public sources to provide financing to make projects financially viable and/or financially sustainable.

Blended finance funds leverage development finance and grant funding to catalyse new investment at scale, into high impact, market-based solutions.

Blended finance is the complementary use of grants (or grant-equivalent tools) and other types of financing from private and/or public sources to provide financing to make projects financially viable and/or financially sustainable.

Blended finance funds leverage development finance and grant funding to catalyse new investment at scale, into high impact, market-based solutions.

The de-risking element results in both lower cost of capital and access to additional finance for non-profit organisations delivering social outcomes.

How does blended finance work?

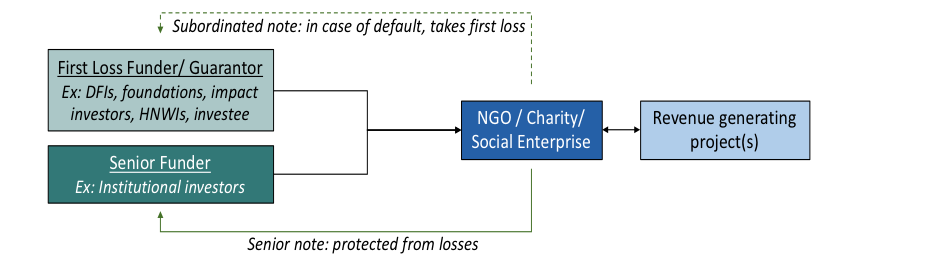

- Impact-first investors (e.g. development finance institutions, foundations, high net worth individuals, even the investee itself) are prepared to accept a greater risk, and/or lower returns

- Finance-first investors (e.g. traditional institutional investors) are interested in supporting impact investments but remain focused on achieving commercial risk adjusted returns

- Guarantees may also be offered

- In case of default, the first loss is taken by the impact-first investors, or guarantor, thereby fully or partially protecting finance-first investors

This approach to structuring finance is known as first loss catalytic capital, or blended finance: it leverages the risk tolerance and favourable terms of impact-first investors to enhance credit, thereby attracting investors for whom otherwise the risk would be too high.

What are the benefits of blended finance?

For the investee:

- Lower cost of capital

- Long-term, predictable source of capital

- Support for capacity building, investment readiness, and post investment management

- Greater flexibility than restricted funding

- Increased capacity to scale and innovate

- Less risky than performance-based contracts

- Diverse network of partners, sector experts, mentors and donors

For the impact first and finance investor:

- De-risking through first loss and guarantees

- Grouping of financial return with social mission

- Increased portfolio diversification

- Regular reporting on social impact generated

- Partnership with organisations possessing local market knowledge and experience

- Lower transaction costs due to investment readiness technical assistance

- Risk management through capacity building technical assistance from DFIs

Examples of blended finance in international development:

Small scale: Equity for Africa leveraged a $1.2m grant from the Dutch government to catalyse an additional $3.6m investment towards equipment finance lending in Tanzania.

Medium scale: Aavishkaar mobilised $94m in blended capital to support BOP entrepreneurs in India. Development funders included IFC, KFW, FMO and CDC while private investors included CISCO and TIAA.

Large scale: The Danish Climate Investment Fund leveraged $94m in public investment to crowd in an additional $142m from institutional investors for climate projects.

A recent report 'Scaling the Use of Guarantees in US Community Investing' by the Global Impact Investing Network (GIIN) points to the contribution that different types of capital can make, where many projects may offer powerful prospects for social and environmental impact, but not meet the needs of more conventional investors who need risk adjusted, market rate returns.

For these opportunities, credit enhancement can unlock private capital to help scale a variety of impact propositions.

Other research such as Catalytic First Loss Capital (GIIN 2013); Shifting the Lens: A De Risking Toolkit for Impact Investment (Bridges Impact+ 2014); Blended Finance Toolkit (The World Economic Forum 2015) and a report by DANIDA (the Danish development agency) are all useful reads on how to mobilise private capital using structured funds.

IFG and blended finance:

In 2014, Investing for Good arranged the world’s first blended finance for social investment in the arts. The fund was supported by the Arts Council England, foundations and private finance.

Investing for Good are currently arranging blended capital facilities for mandates across a wide variety of sectors. These include: finance to support independent media companies in emerging markets, the establishment of a fund to secure long-term affordable workspace for artists in London, a facility to support people living with multiple long-term health conditions, loans to artisanal and small-scale mining communities in emerging markets, and a facility to catalyse the expansion of social enterprise activities for an NGO serving unmet needs in sexual and reproductive health across the Caribbean, and Central and South America.

Investing for Good is a member of Convergence, a platform focused on blended finance transactions that increase private sector investment in emerging markets .

For more information please contact one of the team.

Geoff Burnand, Chief Executive