NEWS

Investing for Good meets Good Finance

Good Finance provides a searchable directory of social investment advisers and funders, in addition providing useful case studies to show how mission-led organisations are using social investment to scale up their activities and their impact

Investing for Good is listed on goodfinance.org.uk, a website whose mission is to help charities and social enterprises navigate the world of social investment.

Good Finance provides a searchable directory of social investment advisers and funders, in addition providing useful case studies to show how mission-led organisations are using social investment to scale up their activities and their impact

Good Finance is jointly funded by Access Foundation, Big Society Capital and DCMS.

The Sound of Social Investment

The intersection between the arts space and social investment is not fully realised. Yet many of the social investors Investing for Good works now realise that if they support social ventures, it is not a great leap to support artistic ones that also confer social value? A triple bottom line of social, financial and artistic return? That’s compelling. In the UK context could an influx of funding of this nature help to replace a hole in the arts budget for the arts, needed after the drastic cuts of recent years?

The intersection between the arts space and social investment is not fully realised. Yet many of the social investors Investing for Good works now realise that if they support social ventures, it is not a great leap to support artistic ones that also confer social value? A triple bottom line of social, financial and artistic return? That’s compelling. In the UK context could an influx of funding of this nature help to replace a hole in the arts budget for the arts, needed after the drastic cuts of recent years?

Looking more narrowly at the music space, charities working in the field have traditionally performed a wide range of functions from supporting grassroots, community-based programs to publicising good causes, to benefit concerts, to educating festivalgoers about environmental sustainability. One that stands out is Help Musicians UK, the leading charity supporting and empowering musicians to have successful careers and lives. In Place of War also does some vital work in places of conflict, as does Musicians without Borders. Music Venue Trust too – a charity that campaigns to overturn closure of small venues across the UK. Long-term they plan to acquire the freeholds of as many of these vital venues as possible.

How to access finance?

In terms of currently accessible finance for those working in music, the main providers of project funding are the Arts Council and the PRS for Music Foundation. The PRS for Music Foundation is entirely music focused and offers small grants. Creative Industry Finance has helped independent record labels, recording studios, producers and artists with advice to create or strengthen their business plan and also offer access to affordable loans. Help Musicians UK match fund crowdfunding campaigns on PledgeMusic. On their website, they also have a particularly useful Funding Wizard tool which can help musicians identify organisations that might support their project. Start ups can find access to new incubator models, perhaps via a soft loan but more likely just grant support at present. Early growth stage organisations can obtain investment and business support from ACE Creative Industry Finance, Esmee Fairbairn Finance Fund and a new programme called Prosper.

Unlocking social investment

Whilst grant funding is where the greatest need is and probably always will be, how can we unlock additional capital in the form of social investment? For now impact investment is most immediately accessible to larger organisations - music venues, live music events or labels that have a social mission through flexible, cheap loans. In some ways impact investors are stricter, as not only do you have to show that you can repay their loan but you also need to be able to demonstrate that you are achieving social outcomes and commit to measuring them. Yet this comes with benefits if you meet the criteria. The money is usually cheaper, more flexible and unrestricted. Usually you need to satisfy three key criteria:

- You must have social objectives and ideally have these be set out in your legal documents

- A high percentage of your revenue should come from trading

- You must be able to demonstrate the social outcomes achieved

The last point can’t be overstated. Without a proper framework for measuring impact, all you have is noise...

Case Study

The Arts Impact Fund is a good example of impact investment working in practice. A £7m initiative with government backing, co-conceived by Investing for Good and set up to demonstrate the potential for impact investment in arts. Its structure reflects the importance of measuring the artistic and social outcomes generated by investees. The Arts Impact Fund receives investment from both ‘finance first’ investors such as banks and ‘impact-first’ investors that may include foundations. It’s small in the world of funds but with a very structure based on blended finance. The fund offers repayable finance on soft terms to arts organisations that can show that they are sustainable, have strong artistic ambitions and positive impact on society. By investing in the arts they want to support more organisations to become enterprising and resilient.

Alex Jarman

Finding a Way Through: Who can Interpret Impact Investing for Investors and Recipients?

Interest in impact investing has never been greater. Institutional investors have been developing their approach to environmental, social and governance (ESG) issues over many years. Now they are beginning to realise that negative screening is not the only or indeed the best approach to satisfying the demands of clients to be more proactive as responsible investors. Options include positive screening, engagement and impact investing – and the latter is the most pro-active approach.

Interest in impact investing has never been greater. Institutional investors have been developing their approach to environmental, social and governance (ESG) issues over many years. Now they are beginning to realise that negative screening is not the only or indeed the best approach to satisfying the demands of clients to be more proactive as responsible investors. Options include positive screening, engagement and impact investing – and the latter is the most pro-active approach.

According to Tideline, nine out of 10 of the largest U.S. asset managers have launched or are exploring strategies for impact investment. https://news.impactalpha.com/major-asset-managers-moving-slowly-but-surely-toward-impact-investing-aa37fc4c8fc0 Should we take this at face value and believe that asset managers are committed to the concept of impact investment? Or are they seeing this as another box to tick to back up their ESG credentials? The reality is no doubt a mixture of both!

People who are genuinely concerned to be responsible investors need to make sure that they are not just helping big investment institutions to ‘greenwash’ their portfolios. Understanding impact investment as a potential responsible investor and being able to access suitable investment opportunities is key. Identifying the risks and choosing appropriate investments brings different challenges to those posed by more traditional investing.

At the same time, organisations that need investment have to ensure that they are identified as suitable recipients. How do they ensure they are ready for potential investors and know how to approach impact investment? For many charities, social enterprises and NGOs this may be the first time they engage with the world of investment so the risks and challenges are also significant for them.

One of the important roles that Investing for Good plays is to act as an experienced intermediary between the very different worlds of investment managers and social enterprises, charities and NGOs. Language, culture, approach to business, timelines and expectations all need to be carefully explored, explained and developed in order for a fruitful, long term relationship to be brokered. Both parties need to understand:

- The distinction between impact measurement and management;

- what outcomes they both need (financial and social/environmental);

- How financial and social/environmental returns can be balanced;

- What data needs to be collected, analysed and shared.

Investing for Good was founded in 2004 on the basis of a simple insight: that the positive use of money can change the world. We were inspired by a new class of investments that mobilised the power of finance to catalyse social good. We believe that helping organisations from very different worlds to understand how they can work together for mutual benefit and helping them to prepare for impact investment is going to be an increasingly important role.

Sally Britton, Chair of Board

A Look at the Market for Social Bonds

A social bond is a bond instrument where the proceeds are exclusively applied to finance a project that delivers social outcomes. Project examples include access to essential services (e.g. health, education and financial services), affordable housing and microfinance. The target population is typically comprised of people who are living below the poverty line, underserved or in some other way excluded and/or marginalised.

A social bond is a bond instrument where the proceeds are exclusively applied to finance a project that delivers social outcomes. Project examples include access to essential services (e.g. health, education and financial services), affordable housing and microfinance. The target population is typically comprised of people who are living below the poverty line, underserved or in some other way excluded and/or marginalised.

IFG has previously arranged the issuance of social bonds for two UK disability charities, Scope and Thera, where the use of proceeds was to provide additional support services to individuals with a learning disability, including in the case of Scope a peer support scheme for parents, support growth in its donor base and the opening of new outlets whose profit would fund additional service delivery.

Other issuances of social bonds include:

- The IFC 2017 Social Bond Programme addresses social issues for targeted populations, such as access to finance for women entrepreneurs, as well as low-income communities in emerging markets

- The Lloyds Bank 2014 Helping Britain Prosper ESG Bond

- The Charity Aid Foundation Bond, set up by the Retail Charity Bonds platform.

How do the Social and Green Bond markets compare?

There is no doubting that to date social bond issuance has substantially lagged that in green bonds. Last month Bloomberg New Energy Finance forecast that green bonds issuance is set to reach $134.9 billion by the end of 2017 (compared to $95.1bn of new issues in 2016), whilst social issuance remains in single digits.

Why is this the case?

Social bonds have various intrinsic features which may explain this:

- Size of capital requirement: A lot of social projects are focused on individuals and services for which the capital requirement is noticeably smaller; whilst £30m would represent a substantial amount for a social programme, £300m is the norm for a large renewable energy project. The exception to this may be affordable housing, which has enjoyed a strong run of recent issuance (as shown in the graphic below);

- Allied to this is a lack of aggregators who have the sophistication to bundle underlying social loans;

- Issuer appetite: the majority of organisations generating social benefit, particularly those with charitable status, do not have the balance sheet to support borrowing at scale;

- Thematic diversity: the range and mixed profile of project types creates complexity for an investor or ratings agents;

- Scope and reporting: A green bond’s purpose can be relatively neatly defined and measured (e.g. total carbon dioxide reduced, renewable energy capacity added) whereas social bond indicators are more likely to be bespoke and involve more complex assumptions around the baseline determination. This adds to the cost of issuing a labelled social bond.

Are there any signs that this may be changing?

As the IFC notes, a bond market aimed at financing projects with social issues has emerged and deepened, supported by the growing number of investors embedding ESG in their investment decisions. The Sustainable Development Goals (SDGs) is increasingly seen as a viable eligibility framework for the use of proceeds. New issues of green bonds are consistently over-subscribed and dedicated thematic bond funds are short of socially-aligned product against mandated thresholds.

Another factor has been the progress on standards. This summer the International Capital Markets Association (ICMA) agreed to turn the social bond ‘guidelines’ into its own set of Principles, separate from but mirroring the more established Green Bond Principles. These contain four pillars: use of proceeds, process for project evaluation and selection, management of proceeds and reporting. Critically, the Social Bond Principles state that “all designated Social Projects should provide clear social benefits, which will be assessed and, where feasible, quantified by the issuer.” IFG, as an experienced impact advisor, has become an observer to the Social Bond Principles and will look to share its expertise with the Working Group in the design of reporting frameworks and selection of indicators to ensure this is given substance and is consistent with wider market initiatives to standardise impact reporting.

Linking impact to yield

Ultimately the market will need to resolve the issue of whether the benefits of labelling a bond as social and committing to impact reporting justifies the time and costs involved.

The holy grail for us though goes beyond this and would see a direct link between the social outcomes being delivered and the pricing of the social bond. Encouragingly we have seen some examples recently across other debt securities where this linkage has been made explicit:

HCT Group is a social enterprise providing transport services and community services raised a £10m package of financing; investor returns included an innovative social impact incentive feature, providing for a reduction in the borrowing rate if HCT met a pre-determined set of impact targets.

Earlier this year, the technology company Philips signed an agreement for a EUR 1 billion loan with an interest rate that’s coupled to the company’s sustainability performance and rating. If the rating goes up, the interest rate goes down—and vice versa.

We would love to see more of this innovation!

Will Close-Brooks, Head of Structured Products

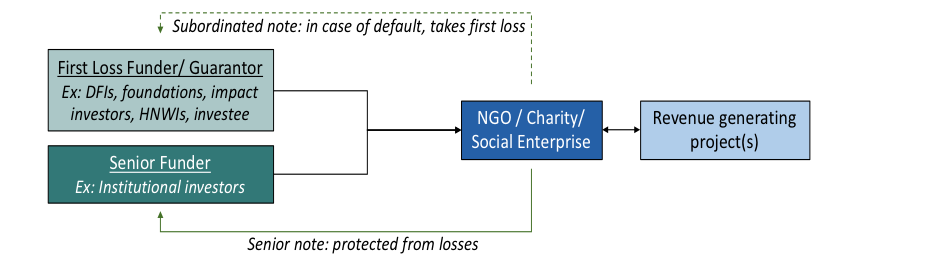

Blended Finance - A Brief Introduction

Blended finance is the complementary use of grants (or grant-equivalent tools) and other types of financing from private and/or public sources to provide financing to make projects financially viable and/or financially sustainable.

Blended finance funds leverage development finance and grant funding to catalyse new investment at scale, into high impact, market-based solutions.

Blended finance is the complementary use of grants (or grant-equivalent tools) and other types of financing from private and/or public sources to provide financing to make projects financially viable and/or financially sustainable.

Blended finance funds leverage development finance and grant funding to catalyse new investment at scale, into high impact, market-based solutions.

The de-risking element results in both lower cost of capital and access to additional finance for non-profit organisations delivering social outcomes.

How does blended finance work?

- Impact-first investors (e.g. development finance institutions, foundations, high net worth individuals, even the investee itself) are prepared to accept a greater risk, and/or lower returns

- Finance-first investors (e.g. traditional institutional investors) are interested in supporting impact investments but remain focused on achieving commercial risk adjusted returns

- Guarantees may also be offered

- In case of default, the first loss is taken by the impact-first investors, or guarantor, thereby fully or partially protecting finance-first investors

This approach to structuring finance is known as first loss catalytic capital, or blended finance: it leverages the risk tolerance and favourable terms of impact-first investors to enhance credit, thereby attracting investors for whom otherwise the risk would be too high.

What are the benefits of blended finance?

For the investee:

- Lower cost of capital

- Long-term, predictable source of capital

- Support for capacity building, investment readiness, and post investment management

- Greater flexibility than restricted funding

- Increased capacity to scale and innovate

- Less risky than performance-based contracts

- Diverse network of partners, sector experts, mentors and donors

For the impact first and finance investor:

- De-risking through first loss and guarantees

- Grouping of financial return with social mission

- Increased portfolio diversification

- Regular reporting on social impact generated

- Partnership with organisations possessing local market knowledge and experience

- Lower transaction costs due to investment readiness technical assistance

- Risk management through capacity building technical assistance from DFIs

Examples of blended finance in international development:

Small scale: Equity for Africa leveraged a $1.2m grant from the Dutch government to catalyse an additional $3.6m investment towards equipment finance lending in Tanzania.

Medium scale: Aavishkaar mobilised $94m in blended capital to support BOP entrepreneurs in India. Development funders included IFC, KFW, FMO and CDC while private investors included CISCO and TIAA.

Large scale: The Danish Climate Investment Fund leveraged $94m in public investment to crowd in an additional $142m from institutional investors for climate projects.

A recent report 'Scaling the Use of Guarantees in US Community Investing' by the Global Impact Investing Network (GIIN) points to the contribution that different types of capital can make, where many projects may offer powerful prospects for social and environmental impact, but not meet the needs of more conventional investors who need risk adjusted, market rate returns.

For these opportunities, credit enhancement can unlock private capital to help scale a variety of impact propositions.

Other research such as Catalytic First Loss Capital (GIIN 2013); Shifting the Lens: A De Risking Toolkit for Impact Investment (Bridges Impact+ 2014); Blended Finance Toolkit (The World Economic Forum 2015) and a report by DANIDA (the Danish development agency) are all useful reads on how to mobilise private capital using structured funds.

IFG and blended finance:

In 2014, Investing for Good arranged the world’s first blended finance for social investment in the arts. The fund was supported by the Arts Council England, foundations and private finance.

Investing for Good are currently arranging blended capital facilities for mandates across a wide variety of sectors. These include: finance to support independent media companies in emerging markets, the establishment of a fund to secure long-term affordable workspace for artists in London, a facility to support people living with multiple long-term health conditions, loans to artisanal and small-scale mining communities in emerging markets, and a facility to catalyse the expansion of social enterprise activities for an NGO serving unmet needs in sexual and reproductive health across the Caribbean, and Central and South America.

Investing for Good is a member of Convergence, a platform focused on blended finance transactions that increase private sector investment in emerging markets .

For more information please contact one of the team.

Geoff Burnand, Chief Executive

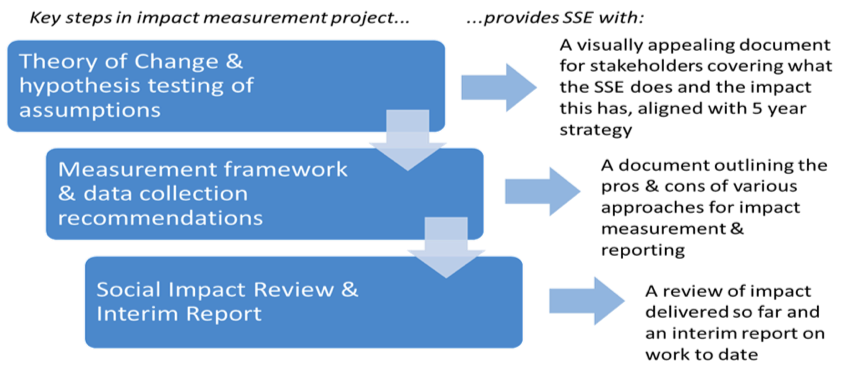

IFG Social Impact Evaluation of the School for Social Entrepreneurs Supports Major Grant Award

We at Investing for Good were delighted that the Big Lottery Fund has renewed its funding for social entrepreneurs, supported by School for Social Entrepreneurs (SSE), with a £2.55m grant.

SSE is a charity with a network of 11 schools, impacting communities across the UK, Canada and India. The charity offer programmes, workshops and short courses, aiming to support individuals on a learning journey, and creating social change together.

We at Investing for Good were delighted that the Big Lottery Fund has renewed its funding for social entrepreneurs, supported by School for Social Entrepreneurs (SSE), with a £2.55m grant.

SSE is a charity with a network of 11 schools, impacting communities across the UK, Canada and India. The charity offer programmes, workshops and short courses, aiming to support individuals on a learning journey, and creating social change together.

The renewal of funding extends Big Lottery Fund’s commitment to the Lloyds Bank Social Entrepreneurs Programme, in partnership with School for Social Entrepreneurs, launched in 2012. The first five years of the programme has supported 1,300 social entrepreneurs. These social entrepreneurs are predicted to reach as many as 1.1 million beneficiaries over five years, according to a social impact review of the programme conducted by CAN Invest and Investing for Good in 2016.

Following a competitive tender, Investing for Good and CAN Invest- a charity committed to helping other charities thrive- were chosen by SSE because both organisations have extensive experience working with intermediary organisations and with the complexities around capturing, measuring impact and attributing impact.

Investing for Good acted as the lead on the project, representing the team and acting as the main point of contact. However, both parties were equal partners during the delivery of the project and worked as one unified team. The partnership made the best use of our respective expertise and experience to date.

We adopted a hypothesis testing approach whereby we developed and tested a number of assumptions in the Theory of Change and the extent to which the activities that the SSE were doing delivered the outcomes that were initially hypothesised.

Mapping backwards from organisational goals, we tested hypotheses around strategic assumptions, placing emphasis on understanding not only whether SSE activities produced the desired effects, but also how and why, throughout the course of different SSE programmes.

This provided the framework for research for SSE to contribute thought-leadership and become a higher profile, leading voice in the intermediary and educational sectors on excellence in supporting social entrepreneurship.

IFG and CAN Invest used a variety of methods including qualitative research with in-person & telephone interviews, focus groups, surveys, social media approaches, narrative story-telling, and more traditional quantitative, statistical based approaches and study designs.

The review captured the whole spectrum of SSE’s impact: its achievements, success factors, learning elements, progress towards strategic goals, and included an analysis of the various programmes and their performance, and the impact of entrepreneurs to date.

The final report was deliberately designed to catch the eye of a wide audience and encourage readers to find out more.

A social audit can be hugely beneficial to an organisation. Social audits evaluate your current impact processes against best practice, identify any gaps and recommendations for improvements, and give you the opportunity to strengthen relationships with grant makers, social investors and commissioners.

More information on our social audit services can be found at https://www.investingforgood.co.uk/social-audit/

IFG works with social investment fund Impact Ventures UK

Check out our latest Social Audit work for Impact Ventures UK. We helped the social investment fund understand how well it assessed the impact of potential and existing investments against best practice.

Grant Programme for Impact Management

Investing for Good is delighted to be an approved provider to the Growth Strand of the Impact Management Programme, funded by the Access Foundation and Power to Change.

Find out how to apply for the grant here

Investing for Good is delighted to be an approved provider to the Growth Strand of the Impact Management Programme, funded by the Access Foundation and Power to Change. The goal of the programme is to support charities and social enterprises to increase their social impact and diversify their income. The programme offers training and grant funding to help organisations develop impact management systems that increase their ability to increase their ability to reliably drive outcomes for beneficiaries and meet the needs of investors and/or commissioners. We can help you put together an application to the grant fund, and work with you to improve your impact management capabilities. £1.8m available in total, with around 40 grants expected to be made, with an average size of £50,000.

What is impact management?

Impact management goes beyond impact measurement. It is about actively using the impact data you collect to manage your performance and improve your services, your outcomes and the lives of your beneficiaries. It is about using your data to learn, and refine your processes and programmes as you go.

Who is this for?

Are you a social purpose organisation operating in the UK?

Are you seeking investment or contract opportunities?

Is your leadership engaged and dedicated to understanding and improving the impact of your organisation?

Do you have theory of Change, and already have somewhat of an impact approach, but need help to improve how you manage your impact on a regular basis? Then this programme could be for you! To find out more about eligibility criteria, click here.

What is the application process?

Find out more

If you want to find us more, call us on 0771 0064 610. Or email us at eoi@investingforgood.co.uk

Big Potential Advanced with Buzzacott

Investing for Good to work with Buzzacott to help organisations secure new forms of investment Big Potential Advanced with Buzzacott

Getting organisations investment-ready Big Potential Advanced is delivered by The Social Investment Business on behalf of the Big Lottery Fund and is aimed at ensuring social organisations are better equipped to secure new forms of investment.

Are you eligible for Big Potential Advanced? Big Potential Advanced supports more established organisations that are looking to raise in excess of £500k. The programme will deliver approximately £10m of grant funding until late 2017 enabling eligible organisations to access grants of between £50k–£150k for specialist investment readiness support from an approved Big Potential provider.

Investing for Good is an approved provider to the fund working in conjunction with its partner Buzzacott and has a longstanding track record of providing investment readiness support.

Impact Platforms - Silver bullets or a poisoned chalice?

IFG’s newest recruits recently travelled to Oxford to sample Marmalade, an open-access fringe event to the Skoll World Forum on Social Entrepreneurship.

IFG’s newest recruits recently travelled to Oxford to sample Marmalade, an open-access fringe event to the Skoll World Forum on Social Entrepreneurship.

We dropped into several sessions during day two of the festival, but it was the workshop entitled - “Silver bullets in slingshots: Beyond killer platforms for social good” that intrigued us the most as we cast our eyes over the bumper five-day schedule of workshops, panels and networking events.

Everyone in the room added a social impact tech platform on a post it and it soon became clear there are lots... and lots...

Even before we arrived, the call to arms was set – to truly overcome the planet’s greatest challenges and properly harness the collective groundswell of energy for change, wouldn’t it be better if all those in the impact investment space thought beyond our own, sometimes niche, networks and platforms and considered how greater inter-connectivity could be built into our current work streams? Therefore, to truly create an ecosystem that was greater than the sum of its parts and capable of moving innovations and capital at scale.

The two-hour session was led by Astrid Scholz (CEO, Sphaera) and Audrey Selian (Director, Artha Initiative). We started by crowd-sourcing names of the many, many platforms that exist in the space. The photo below is proof of the fragmentation within the sector and collectively represents an outlay of over £60m on development costs alone, while only one platform has achieved financial sustainability to date.

After a lively debate about the virtues and pitfalls of the aforementioned platforms, our hosts shared an update on a recent project where they had sought to break free of their own organisational silos.

Astrid & Audrey explained how they had come to realise that their respective organisations had essentially been operating at opposite sides of the same coin. For Sphaera, the focus is at the “ideation” stage – identifying, sharing and scaling solutions, while Artha provide the information management platform for entrepreneurs, investors and intermediaries to collaborate. Traditionally, both offerings would function separately with end users needing twice the amount of account logins, time and patience to participate.

The key to the Sphaera- Artha collaboration was opening back-end systems through APIs (application programming interfaces) to share information seamlessly – so the end user can use each of their preferred specialist tools without having to repopulate data over and over. Think using your Google account to speed around the web with a single-sign on.

Of course, a change in mindset away from platforms purely competing with one another is first required; impact communities exist and impact technology exists to connect those communities, but in the market at present no provider is big enough for the data layer to become sufficiently scaled to truly drive outputs. To make this happen either the number of technology platforms will have to consolidate, or the various actors must find a way to share data more successfully and accept that being part of a larger, richer eco-system where each other’s objectives, incentives and financial realities are acknowledged. This is where real progress will be made. The theory extends that that this will also encourage and enable platform creators to offer one service well rather than several services poorly.

Clearly there are real challenges over data sharing and other trust issues that will need to be worked through sensitively, but the aspiration is to make this sector more collaborative and efficient by providing participants the tools to act in this way.

Our hosts promised to update us over the summer on the progress of their project and we look forward to seeing the outputs of case studies that showcase how organisations have fared in the real world and the opportunities that greater access and API’s can offer to us all.